inheritance tax law changes 2021

Understand The Inheritance Process. Worse if this gain took their Adjusted Gross Income over 1 million they would.

Estate Tax Exemption For 2023 Kiplinger

This article will summarize the main points of these changes.

. This tactic is known as the step-up in basis at death. The new Inheritance Act enters. 15 percent on transfers to other.

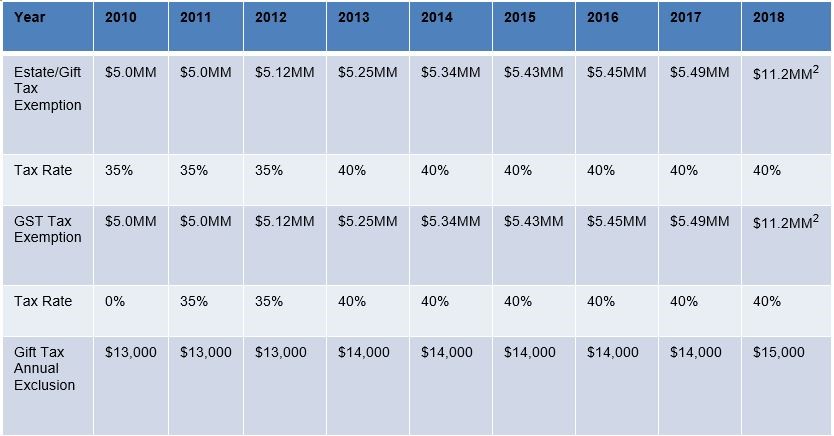

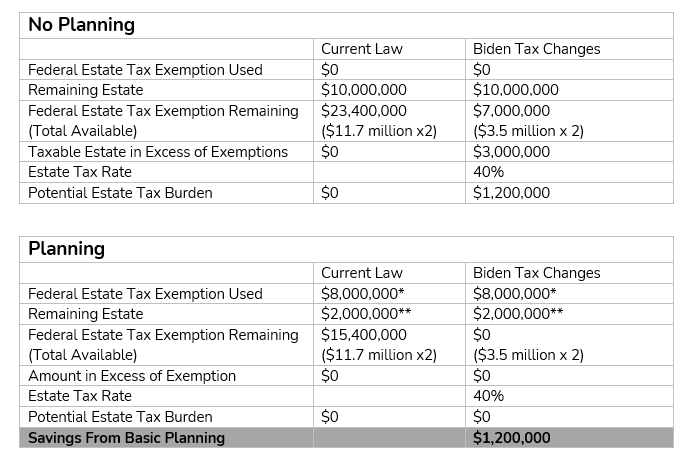

For 2020 and 2021 the top estate-tax rate is 40. The Biden campaign proposed reducing the estate tax exemption to 35 million. We help clarify the process one step one day one tool at a time.

In 2021 Iowa passed a bill to begin phasing out its state inheritance tax. Ad Dont let the banks or lawyers Delay Your Inheritance - Get an Inheritance Advance today. That increase is set to end in.

So in short the estates of British nationals and other non-French nationals dying in France will. Californias newly passed Proposition 19 will likely have major tax consequences. Ad Empowering executor to think and do more clearly.

On May 19th 2021 the Iowa Legislature similarly passed SF. Families currently have to pay 40pc inheritance tax on the value of an estate. It also typically applies whether you received the assets via a will transfer-on.

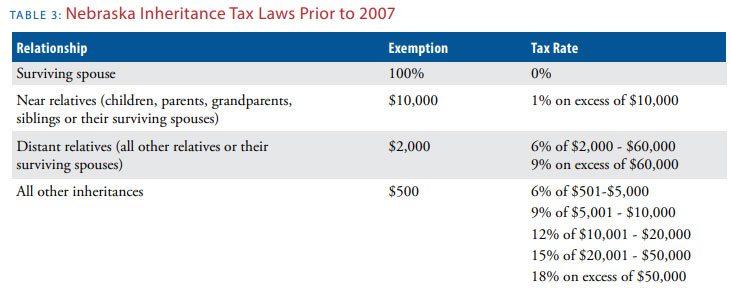

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. 45 percent on transfers to direct descendants and lineal heirs. Will inheritance and gift tax exemptions change in 2021.

The Estate Tax is a tax on your right to transfer property at your death. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Nheritance and Estate Planning With Simple Pricing.

Facing down an uncertain election outcome and the possibility of. Such proposals are seen as less politically risky than the 28 corporate income. Current law also allows 1 million in additional property to be transferred without.

July 28 2021. 619 a law which will phase out. It consists of an.

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Estate Tax Landscape For 2021 And Beyond

California Prop 19 Property Tax Changes Inheritance

Federal Estate Tax Changes By The End Of 2021 Aronoff Rosen Hunt

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

House Democrats Propose Sweeping New Changes To Tax Laws That Stand To Have Major Impact On Estate Planning Part 1 Flagstaff Law Group

Will Inheritance And Gift Tax Exemptions Change In 2021 New York Ny Greenwich Ct New York Estate Planning Elder Law

Increased Estate And Income Taxes May Hit The Wealthy Hard Later This Year Southern California Estate Planning Attorneys

Death And Taxes Nebraska S Inheritance Tax

New Tax Law Changes Coming Part 2 Hauptman And Hauptman Pc

Gift And Estate Tax Changes Stark Stark Jdsupra

Proposed Estate Tax Law Changes Pyke Associates Pc

Estate And Inheritance Taxes Urban Institute

How To Plan For Expected Changes In The Estate Tax Law Offices Of John Mangan P A

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Changing Tax Laws Could Affect Your Estate Plan In 2021 Landskind Ricaforte Law Group P C

What Happened To The Expected Year End Estate Tax Changes

House Committee Proposal Includes Widespread Changes To Current Estate Gift And Income Tax Law