is pre k tax deductible

If a child attends a college or university private or public education tax credits can be used to deduct the costs of tuition books and other required supplies. 475 18 votes.

Is Preschool Tax Deductible Sometimes

My son is four and goes to pre-K and a private school.

. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. A credit called the Child and Dependent Care.

Best States for Pre-K. Small business tax prep File yourself or with a small business certified tax professional. Have A Qualify Child.

If you have received childcare compensation from your employer you should deduct that from your total expenses in computing the credit as directed by Form 2441. Can I write off the tuition I pay the school for pre-K as a. Kindergarten costs are generally not eligible for any tax credits or deductions.

A credit called the Child and. Preschool fees are generally not tax-deductible from a parents taxes. If youre wondering whether preschool costs are tax deductible.

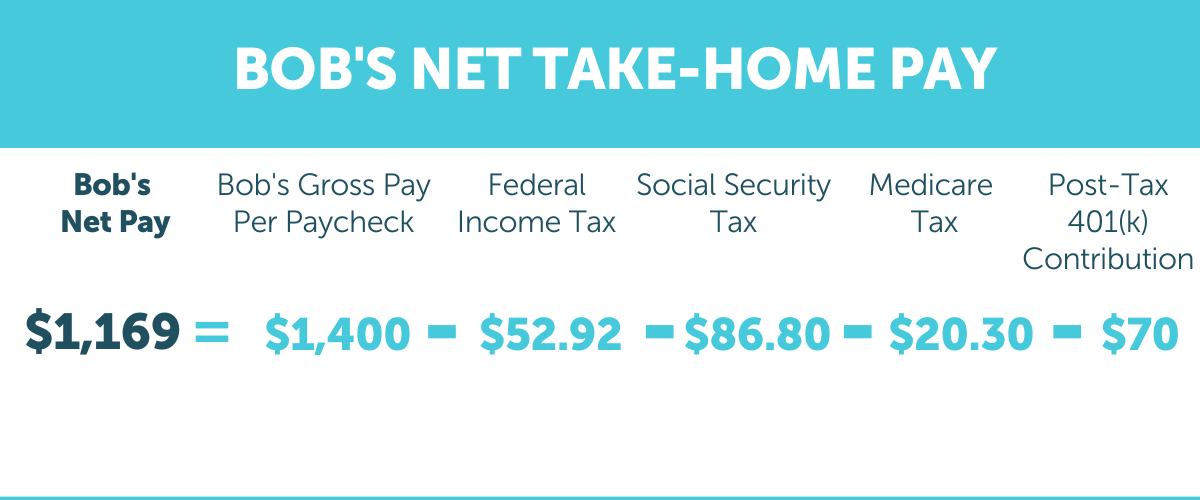

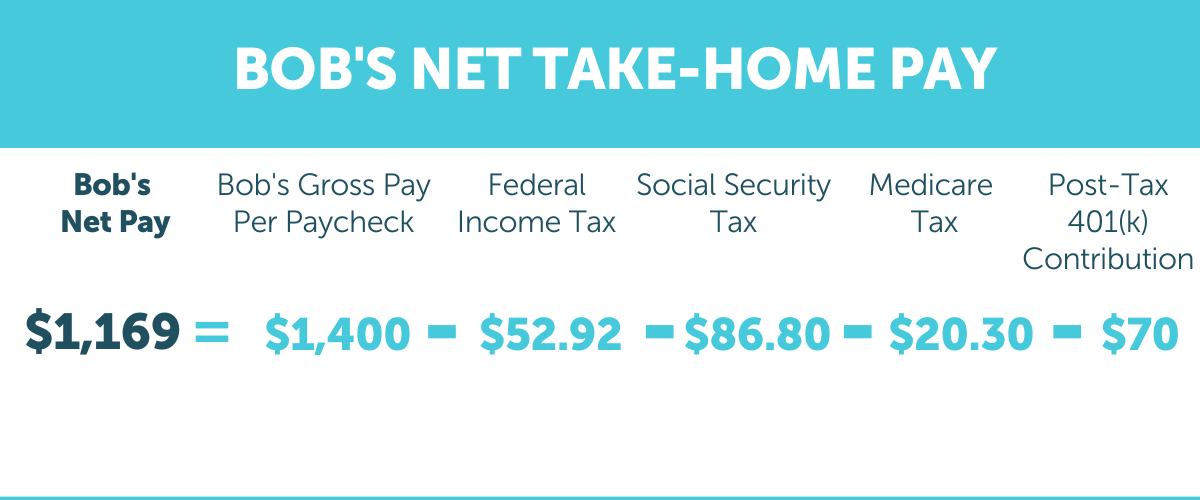

A qualifying child is under the age of 13. They may be but the IRS has set out strict requirements. A pre-tax deduction is money you remove from an employees wages before you withhold money for taxes lowering their taxable income.

Assuming you meet these qualifications during the 2021 tax year you can claim up to 50 of the first 8000 that you spend on preschool tuition and other care-related expenses. How 401 k deductions work. Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit.

Ordinarily a taxpayer can only confer 16000 a year for 2022 15000 for 2021 to each grandchild or anyone else for. Children are required to go to school at age five for kindergarten. Nursery school preschool and similar pre-kindergarten programs are considered child care by the IRS.

Children are required to go to school at age five for kindergarten. Any type of school payment pre-school elementary middle school or high school is not tax-deductible Rafael Alvarez. Is pre k tax deductible sunday july 10 2022 edit.

Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit. Additionally you might consider. Pre-tax deductions go toward.

And these credits can be very helpful for parents. The IRS does not offer tax breaks for the education expenses incurred for students in kindergarten through high. Expenses under kindergarten preschool tuition day care etc are always eligible even if the program is educational.

Nursery school preschool and similar pre-kindergarten programs are considered child care by the IRS. Tuition for kindergarten and up is not an eligible expense. A child must be determined as your qualifying child in order to receive the child and dependent care credit.

This tax benefit is available for nursery and other pre. Bookkeeping Let a professional handle your small business books. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover.

Summer day camps also count as child care.

August Appeal Epiphany Catholic School

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

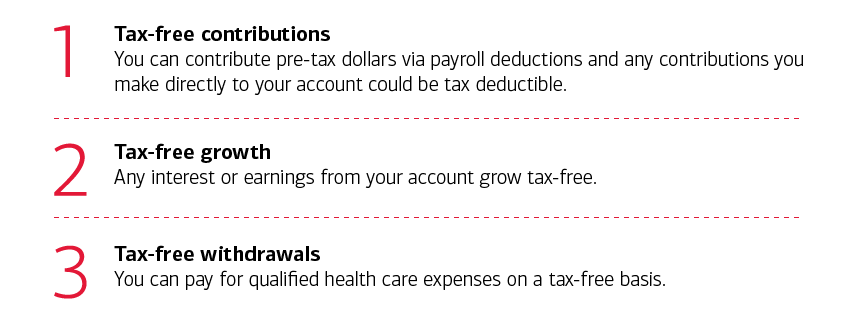

Realize The Potential Of Hsa Tax Benefits

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Are 403 B Contributions Tax Deductible Turbotax Tax Tips Videos

Education Tax Benefits 6 Tax Deductible Expenses Cfnc

Can I Claim Expenses For Preschool As A Tax Deduction

Different Types Of Payroll Deductions Gusto

Is Preschool Tuition Tax Deductible Sapling

Pre Tax Vs Post Tax Deductions What S The Difference

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

Your 2021 Child Care Costs Could Mean 8 000 Tax Credit

Can I Claim Private Pre K As A Tax Deduction

My Son Is Four And Goes To Pre K And A Private School Children Are Required To Go To School At Age Five For Kindergarten Can I Write Off The Tuition I Pay

Is Kindergarten Tax Deductible H R Block

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Pre Tax Vs Roth Contributions What S Best For You Brighton Jones